GTM is not just about channels, campaigns, or outbound volume. It is about how quickly a business can learn from the market and adapt its outreach. And no system influences that learning loop more than the CRM.

In my view, when CRM is left out of GTM thinking, companies don’t just underuse a tool, they slow down their ability to compete.

Why GTM is where the CRM value concentrates?

GTM is an activity that transforms a business in and out. Teams are constantly testing and refining:

Messaging and positioning

Acquisition and expansion channels

Pricing and packaging models

Territory design and coverage

Sales motions (PLG, sales-led, hybrid, partner)

These experiments overlap, influence each other and often change mid-stream. In this phase, what determines success is not just creativity—it is the speed of feedback, and how quickly teams can operationalize change. CRM is the only system capable of enabling that at scale.

Point solutions can optimize individual steps like outbound, enrichment, or sequencing. But GTM leadership needs a system that connects:

Who the business is targeting

How it is engaging them

How the customers are responding

And whether they’re converting

CRM gives GTM teams a common playground to run experiments, measure outcomes, and scale what works. And its impact goes far beyond sales numbers. A shared GTM understanding shapes how finance, marketing, and HR function, and deliver value as well.

GTM Finance

In most companies, financial planning starts with a number. Everything else is backfilled around that.

We need to grow X% this year.

A GTM strategy grounded in active analysis, fundamentally changes how finance thinks about revenue. Instead of planning around targets, finance starts planning around GTM throughput:

How many qualified opportunities does one rep actually convert in a quarter?

Where do deals slow down — early qualification, pricing, or approvals?

Which segments move fast, and which ones absorb disproportionate effort?

This enables finance to:

Model unit economics like CAC, LTV, and margins accurately

Understand capacity constraints by segment, region, and motion

Design quotas and compensation

Run pricing and packaging experiments

Forecast revenue reliably

As a result, revenue planning shifts from top-down targets to bottom-up, execution-led models, and board-level reporting becomes faster, cleaner, and more credible.

GTM Marketing

In a well-strategized GTM motion, marketing is not measured by volume of activity, but by quality of signal.

Marketing decisions are sharper because:

Channels are evaluated based on downstream impact

Messaging is refined based on where prospects disengage

This leads to fewer launch and move on campaigns, and ensures experimentation actually compounds instead of resetting every quarter.

GTM HR

In fast-growing teams, hiring often happens reactively.

“The pipeline is slipping. We need more reps.”

“ The business is growing, we need to expand the team”

And that is the fastest way to increase cost before you increase throughput. This has been a perpetual business dilemma. What usually follows is predictable. Headcount goes up immediately, but productivity doesn’t. This is how a poor GTM system compensates in unhealthy ways.

A routine evaluation of GTM motions enforces discipline. It forces leadership to answer much harder and more useful questions:

What roles does our GTM motion actually require?

Where does work break down — prospecting, qualification, closing, expansion?

Which failures are skill-related vs system-related?

This clarity allows HR and GTM leaders to:

Design roles that reflect real workload and complexity

Build onboarding around GTM milestones

Diagnose performance issues accurately, provide better coaching and career paths

Over time, this reduces attrition, improves long-term organizational structure.

This is why CRM value concentrates in GTM. Not because it supports sales activity, but because it becomes the system through which GTM strategy is run, measured, and evolved.

CRM For GTM Strategy Success

To succeed with GTM strategy, teams must expand their CRM knowledge, invest in building the system, and align measurement with GTM experiments and motions.

Every organization starts with multiple extraction tools, overlapping data sets, and manual updates. No one starts with clean data and fixed processes. Teams optimize for speed over structure. Hence, CRM understanding begins with knowing that no CRM magically solves data problems. Every system still relies on CSV imports, external enrichment tools, and human discipline to function well. This reality is important, because it reframes what “good CRM setup” actually means.

A CRMs primary job is to preserve signal integrity despite imperfect inputs. That’s why standardization must be ruthless around GTM-critical dimensions:

Account identity and domain (non-negotiable for ABM)

Industry and sub-industry (controlled picklists, not free text)

Geography and ownership (clear rules prevent downstream reporting collapse)

Activity taxonomy (calls, emails, LinkedIn, WhatsApp tracked consistently)

At the same time, since GTM success depends on running experimentations, the CRM should not be overly standardized either.

Core account and activity fields are fixed.

Campaign tags, project tags, or product tags remain flexible.

That is why we chose to build a clear evaluation framework when we decided to set up a CRM for our operations. We have compiled all of our evaluation pointers in a google sheet. You can request access for the free Google Sheet here.

Having worked extensively with CRMs over time, we’ve developed a distinct way of evaluating their dashboards. And that approach can unlock fundamentally new ways to generate and protect value across go-to-market motions.

CRM Analytics For GTM Decision-Making

The truth is GTM success does not come from tracking every possible metric. It comes from focusing on a set of high-leverage indicators across the revenue engine.

In our experience, three CRM metric clusters consistently stand out as value creators. They directly influence how GTM strategies are discussed, planned and executed.

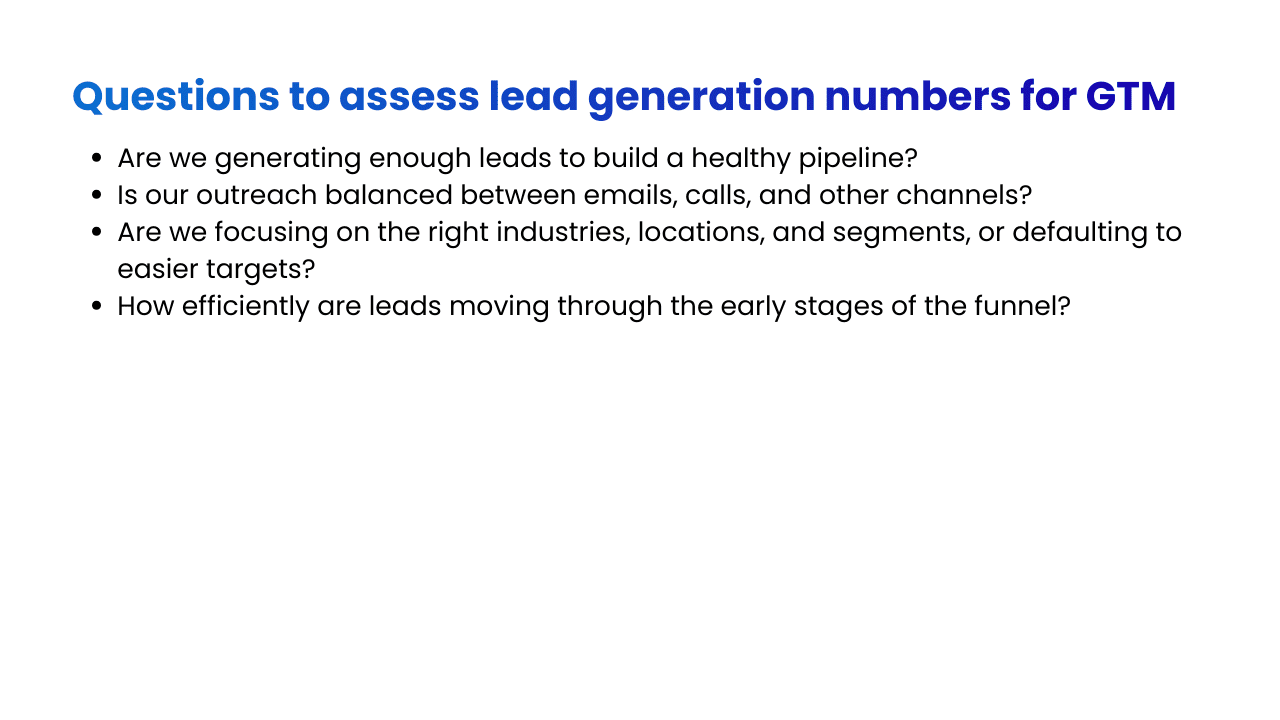

Cluster 1: Lead generation

This cluster shows whether the top of the funnel is healthy. It helps teams see if the outreach is reaching the right prospects, if pipeline momentum is building, and whether efforts are focused where they’ll matter most.

It gives clarity on whether your engine is primed to generate opportunity—or if it’s running on empty.

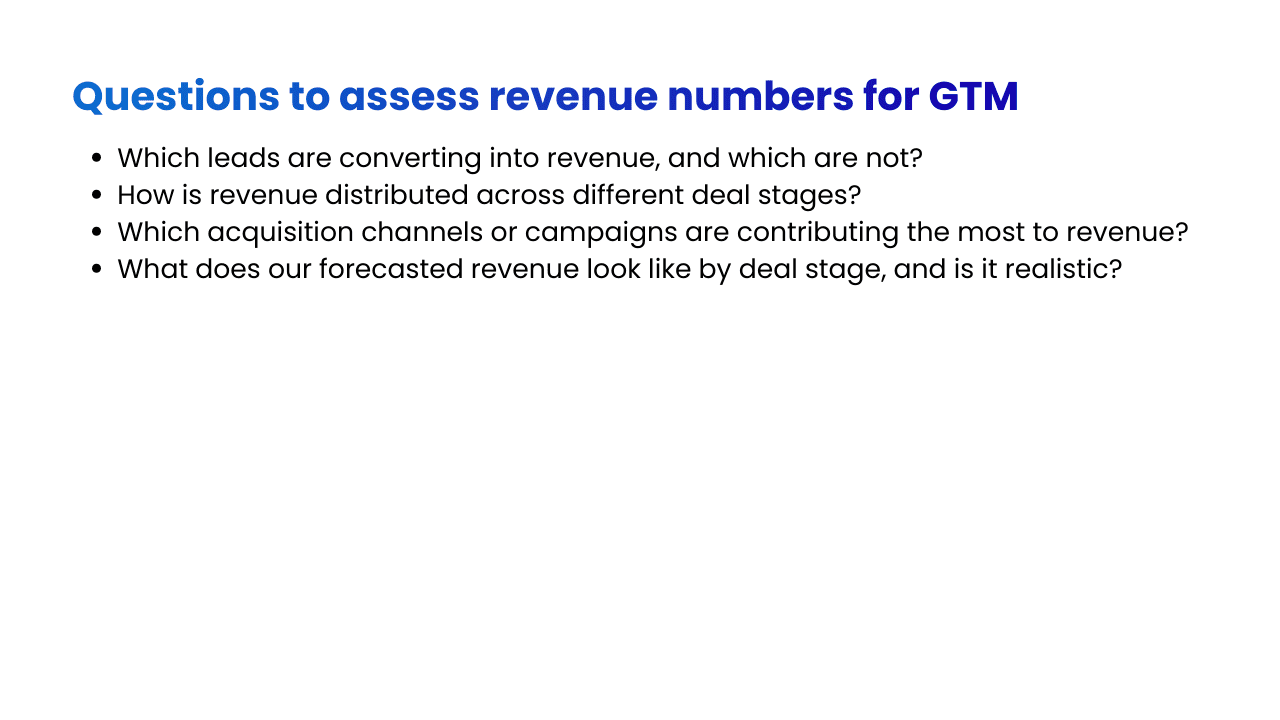

Cluster 2: Revenue Conversion

This cluster highlights which activities actually drive results. It helps teams understand whether leads are translating into revenue, which paths are most effective, and where the real value is coming from.

It’s about turning effort into impact. It shows where the team is winning and where attention is needed.

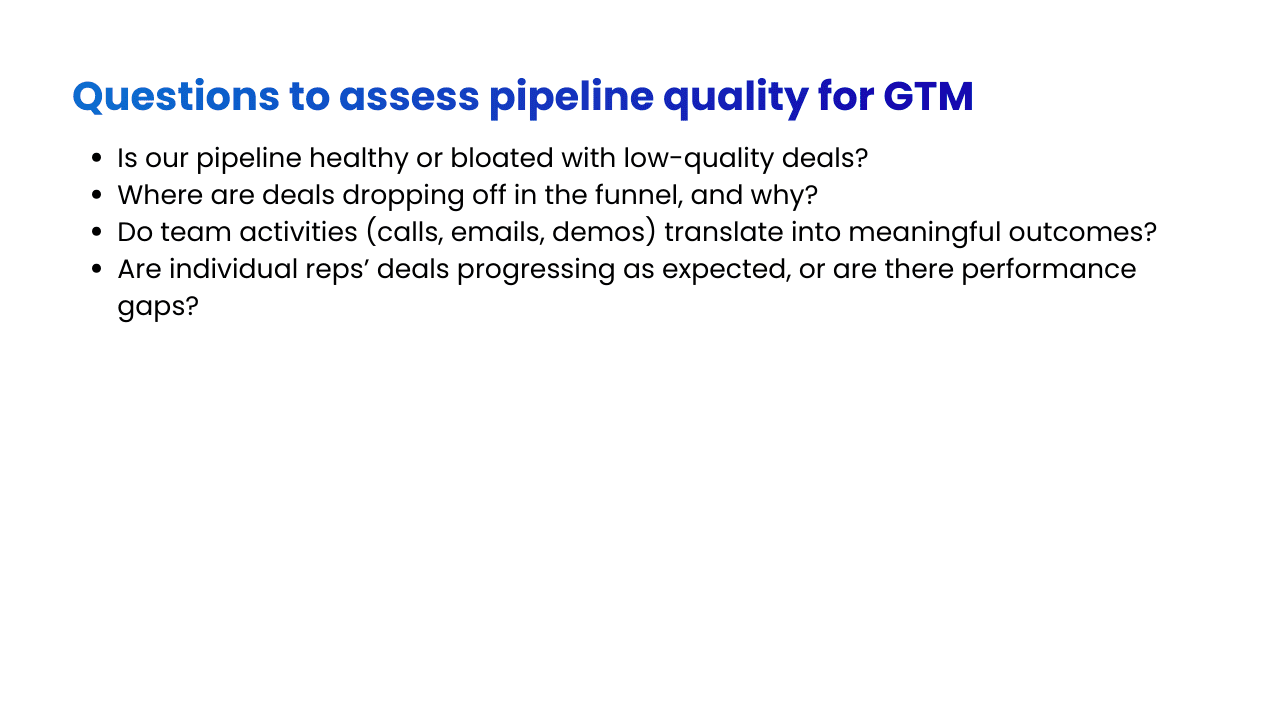

Cluster 3: Pipeline Quality

This cluster focuses on the health and strength of opportunities. It helps teams separate high-value deals from low-quality noise, identify friction points, and ensure that effort is going toward opportunities that can realistically convert.

We recently shared a short post on how the above analyses can be done using Zoho, Freshsales and Pipedrive.

Treating CRM as a strategic GTM asset is easy to agree with in theory. In practice, it requires a lot of discipline. CRM only creates value when teams are willing to do the unglamorous work: making hard choices about standardization, enforcing definitions, debating metrics, cleaning data, and continuously reshaping the system as GTM motions evolve.

A CRM does not become central to GTM because it exists. It earns that role by repeatedly helping teams see reality faster, make better trade-offs, and act with confidence. When built and used this way, CRM stops being a reporting tool and becomes a learning engine. And in a world where GTM advantage comes from how quickly you learn and adapt, that learning engine is decisive.